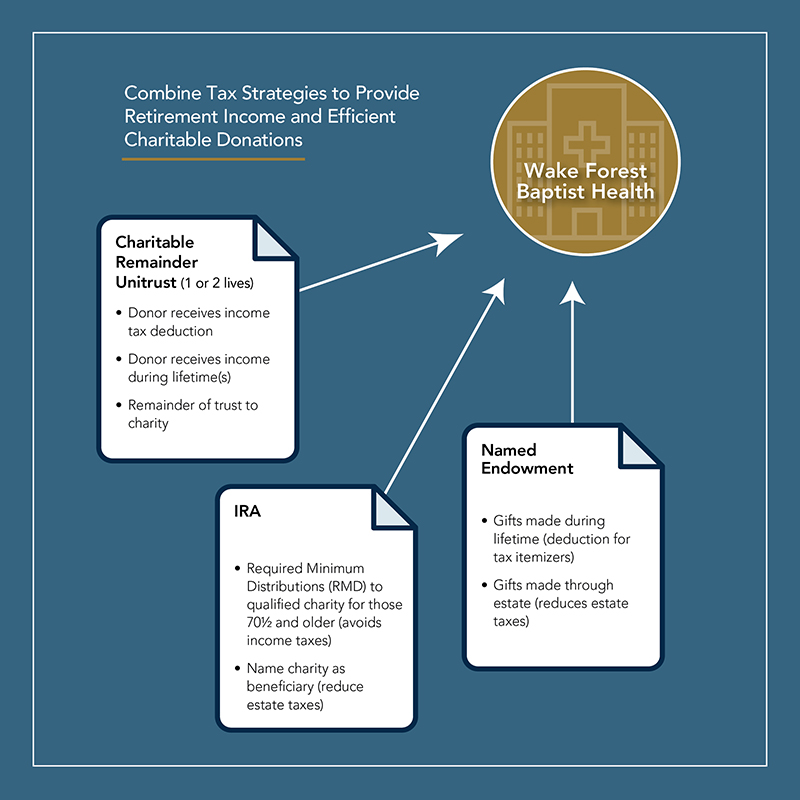

For those with qualified retirement plans, these plans may represent a significant percentage of your assets. If assets in those plans are passed to an heir such as a child, the recipient must pay income taxes known as Income in Respect of a Decedent (IRD). There is an exception. If a qualified charity is named as beneficiary for all or a portion of the assets in a qualified plan, the qualified charity will NOT pay taxes on the distribution it receives.

We are happy to help you learn more about charitable giving options that fit your needs. Call or email today: 336-716-1058 or losowski@wakehealth.edu.