A trust is an estate planning tool for managing assets. While there are several types of trusts, the one you choose depends on your goals and circumstances.

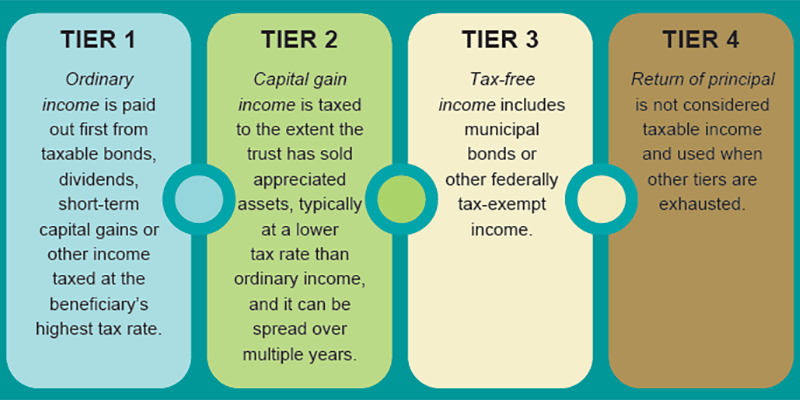

For instance, a charitable remainder trust (CRT) supports charitable causes and provides income with tax benefits. These benefits generally include a tax deduction when the CRT is established. There are also tax benefits within the income payments. CRT payments are taxed under a four-tiered system that reflects the order in which income is distributed to a recipient (like yourself):

TIER 1: Ordinary income is paid out first from taxable bonds, dividends, short-term capital gains or other income taxed at the beneficiary’s highest tax rate.

TIER 2: Capital gain income is taxed to the extent the trust has sold appreciated assets, typically at a lower tax rate than ordinary income, and it can be spread over multiple years.

TIER 3: Tax-free income includes municipal bonds or other federally tax-exempt income.

TIER 4: Return of principal is not considered taxable income and used when other tiers are exhausted.

An Example

A donor establishes a 6% CRT on Jan. 1, 2024, with $300,000 in appreciated securities that were acquired for $200,000 and held for longer than a year.

When the trust sells the stock, $100,000 of long-term capital gain is generated. The trust does not pay tax on this gain, but the gain is captured in Tier 2 distributed income, and the $200,000 basis is eventually captured in Tier 4 as not taxed. Let’s say the trust earns $6,300 in ordinary income that year. As a result, income payments reflect applicable tiers in order, beginning with Tier 1.

Each year, the trustee files a tax return for the trust and provides the income beneficiary with a Schedule K-1 that identifies how trust payments are to be categorized for income tax purposes. When the CRT ends, the remainder passes to a charity identified in the trust, like our organization, for a purpose you designate.

Contact

If you are interested in a personalized CRT illustration, please contact Lori Osowski at 336-716-1058.